| Healthcare Services |

|

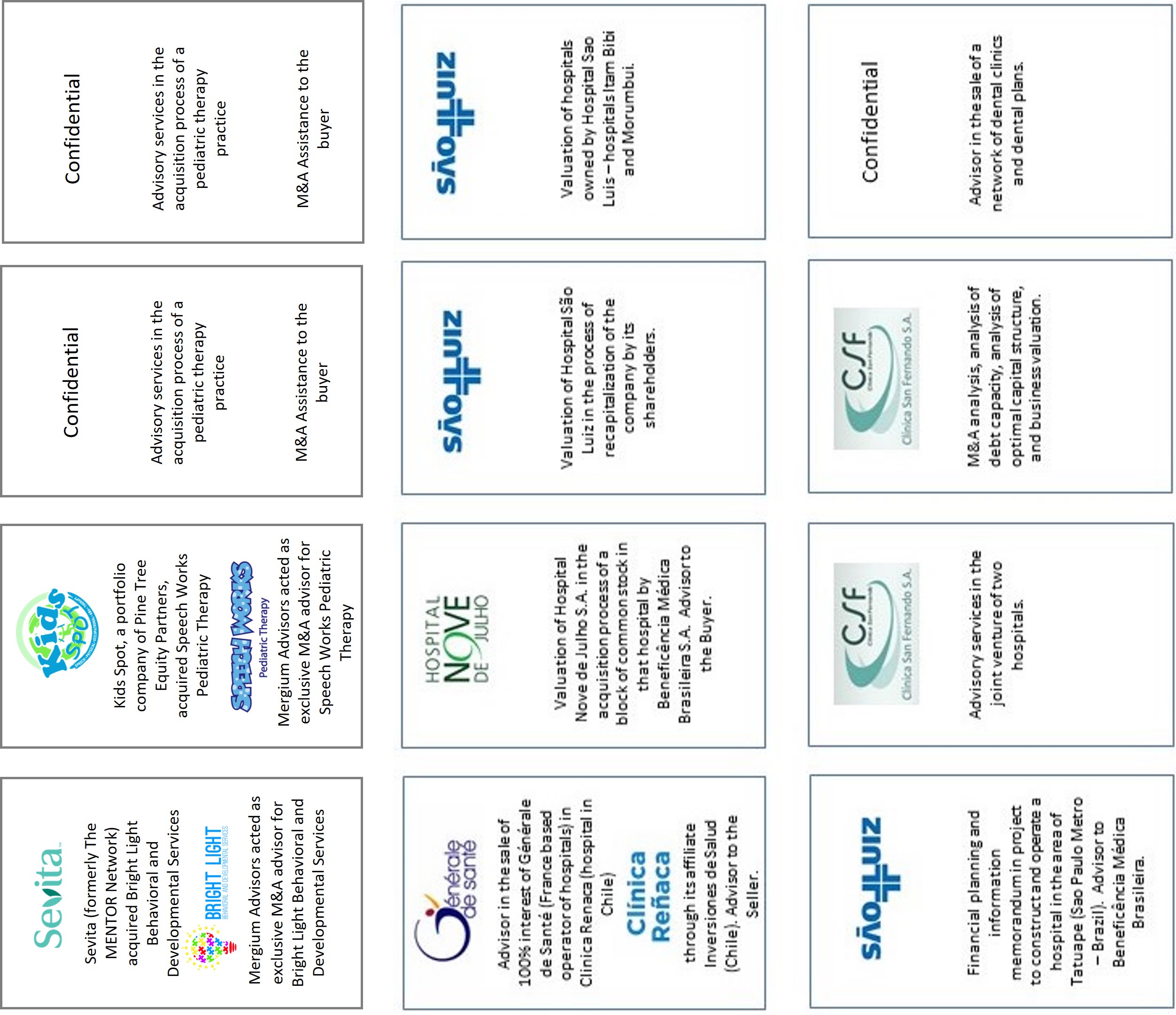

Featured Transaction: Mergium Advisors Inc. (“Mergium”) was the exclusive M&A advisor to Bright Light Behavioral and Developmental Services LLC, in its sale to Sevita (formerly known as the Mentor Network), a portfolio company of Centerbridge and The Vistria Group. Bright Light Behavioral and Developmental Services, LLC provides applied behavior analysis in South Carolina and Georgia. The Company offers services to children diagnosed with the autism spectrum disorder between the ages of 0-20 years. Services are provided at its outpatient pediatric therapy clinics or in the child's natural environment (home, day-care, or preschool). Further information on Bright Light is available at www.brightlightbehavioral.com. Sevita (formerly The MENTOR Network) is a leading provider of home and community-based specialty health care, with 40,000 employees serving over 50,000 individuals. Sevita serves adults and children with intellectual and developmental disabilities, individuals with complex care needs, people recovering from brain injury, seniors in need of everyday support, children in foster care, adults and children with autism spectrum disorders, and other individuals who may require care across a lifetime. Further information on Sevita is available at https://sevitahealth.com/

Testimonial from Caitlin Harvey, Managing Member of Bright Light: "I am very satisfied with the services provided by Mergium Advisors. Luis made the process seamless and ensured success during the entire process. He provided his services throughtout the sale of my company and provided an honest and accurate representation of the value our company held. He ensured buyers in our market were presented with the best information to entice potential buyers to see the value of my company. Luis is very detailed oriented and was steadfast in finding a quality fit for my selling process. I am pleased with the results and would recommend his services".

Featured Transaction: Kids SPOT, a pediatric therapy company that provides speech (ST), occupational (OT), physical (PT) and ABA (applied behavior analysis) therapies and a portfolio company of Pine Tree Equity Partners, acquired Speech Works Pediatric Therapy. Speech Works provides OT, PT, and ST for children at their six outpatient clinics and at the child's natural environment (home, daycare, and preschool). Mergium Advisors served as exclusive M&A advisor for Speech Works.

Testimonial from the owner of Speech Works Pediatric Therapy - Ms. Karen Horton: "Luis and I worked together on the sale of my pediatric therapy practice. I found him to be honest, knowledgeable, and attentive to the needs of both the buyer and myself as the seller. Luis brings incredible value to both sides of the transaction, and I always felt comfortable with every step in the sale process. I often felt that on many occasions he was an advocate and a teacher since this process can be emotional and overwhelming. Having the unique experience of working with Luis, I would not hesitate to recommend him to anyone who is considering selling their business." Experience of team members at Mergium and at other firms:

|

.jpg)